Wealth Plus Digital Platform developed by Elsner

Wealthplus aimed to transform financial management with a cutting-edge cross-platform application and website, integrating Bank,…

Read MoreLeading wealth management firms and fintech innovators partner with Elsner for transformative digital solutions that drive measurable business outcomes. Our proven expertise in delivering secure financial data platform development and scalable technology ecosystems has established us as a trusted enterprise digital solutions partner.

We integrate enterprise-ready capabilities into unified wealth tech digital ecosystems, combining AI-powered intelligence, robust ecommerce functionality, advanced engineering, and secure enterprise systems to deliver transformation-led solutions that scale with your business.

Accelerate your digital transformation with our pre-built, enterprise-ready solutions designed for rapid integration. Each solution is designed for scalability, security, and seamless deployment into existing wealth tech ecosystems.

Wealthplus aimed to transform financial management with a cutting-edge cross-platform application and website, integrating Bank,…

Read More

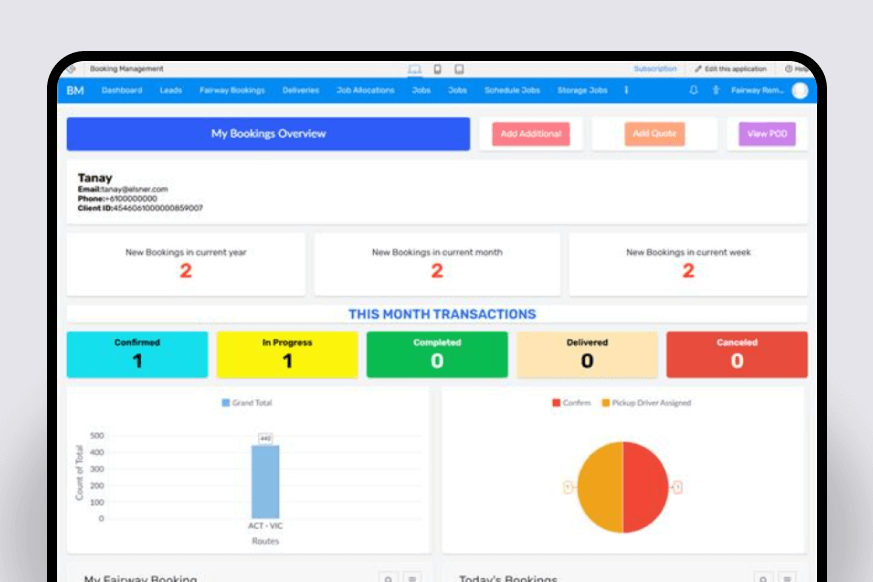

Fairway Removals, a trusted relocation and transport service in Melbourne since 1993, needed a smarter…

Read More

For a Direct-to-Consumer (D2C) brand, we integrated Zoho CRM and Zoho Inventory with Shopify and…

Read More

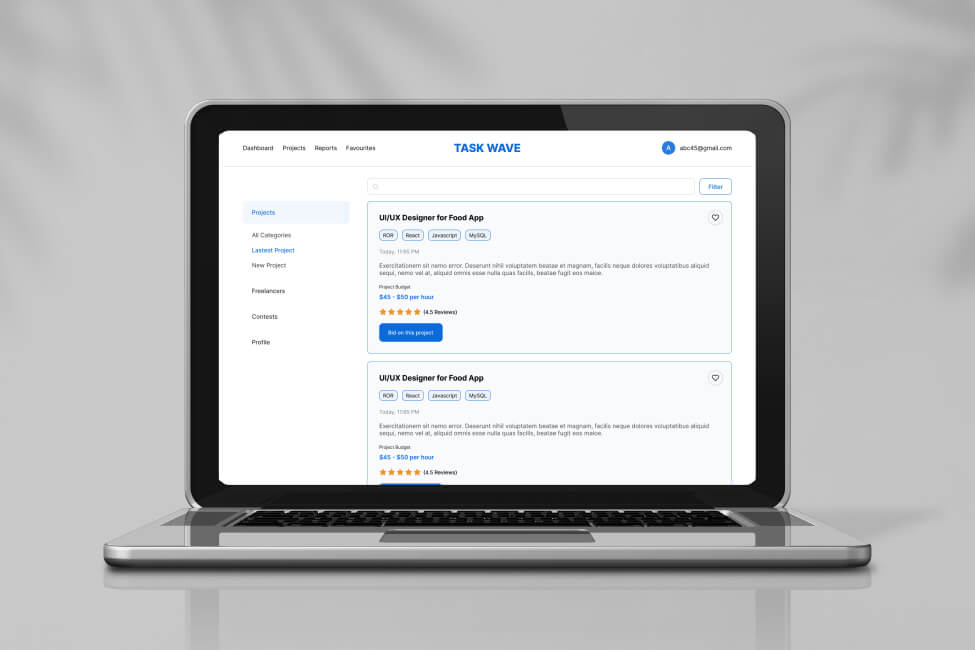

Task Wave is an innovative online platform designed to connect freelancers and clients from diverse…

Read MoreDiscover how our enterprise digital solutions deliver measurable outcomes across AI intelligence, secure ecommerce platforms, advanced engineering, enterprise integrations, digital marketing excellence, and mobile innovation.

AI-driven insights that improve client engagement, personalization, and portfolio performance.

We deployed AI Powered Wealth Management Solutions using behavioral analytics, predictive modeling, and intelligent recommendation engines. These systems analyzed transaction patterns and risk profiles. The result was more relevant investment guidance.

The platform processed client data in real time. It identified opportunities for portfolio optimization and proactive advisor outreach. Client engagement increased by 47%. Portfolio reviews grew by 62%. Assets under management per client rose by 28%. This generated $3.2M in annual revenue.

A scalable digital platform that helps advisory firms expand services while maintaining trust and control.

We engineered a secure digital platform with automated billing, tiered service packages, and real-time account management. The solution followed best practices from Fintech Platform Development Services.

Clients subscribed and managed preferences online. Digital subscriptions increased by 53%. Manual processing dropped by 41%. Client satisfaction reached 89%. Operational costs fell by 34%.

Our enterprise-grade solutions combine modern technology, strong security practices, intelligent automation, and seamless integrations. The focus is sustainable growth and operational excellence.

Upgrading outdated systems to improve scalability, reliability, and cost efficiency.

We modernized the platform by refactoring modules and optimizing databases. We introduced microservices architecture. The system remained operational throughout the process. This approach reflects proven Wealth Management Software Development practices.

Page load times dropped by 76%. Critical bugs reduced by 94%. The platform scaled to handle 10x transaction volume. The modernization extended system life by seven years. It saved $4.8M in replacement costs.

Connected systems that eliminate silos and reduce manual workflows.

We built unified enterprise software integrating Salesforce CRM with portfolio management, compliance, and reporting platforms. This supported Investment Portfolio Management Software workflows.

Manual data entry dropped by 87%. Client onboarding time reduced from 14 days to 3 days. Data accuracy improved to 99.7%. The platform supported growth without added technology overhead.

Our wealth tech transformation approach delivers clear results across client acquisition, operational efficiency, revenue growth, and market positioning.

A structured inbound strategy that builds authority and attracts qualified leads.

We implemented an SEO-driven content hub and marketing automation platform. The solution included analytics and conversion-focused design. This approach supports modern Wealth Tech Digital Transformation Services.

Organic lead generation increased by 217%. Cost per qualified lead dropped by 58%. Marketing-driven revenue reached 34% of new acquisitions. This added $2.1M in revenue.

Mobile-first solutions that support advisors and clients anywhere

We developed native iOS and Android apps with biometric security and offline access. The apps synchronized seamlessly with enterprise systems. They followed Secure Financial Data Platform Development standards.

Adoption reached 71% within five months. Branch visits dropped by 64%. Advisors closed 38% more business. Client satisfaction improved by 29 points.

Clients trust Elsner for clarity, consistency, and results. We approach every engagement with strategic focus and technical discipline. Our teams deliver measurable outcomes across Robo Advisory Platform Development, RegTech Compliance Automation Solutions, and enterprise-scale innovation. Each solution is built to support growth, compliance, and long-term success.

Wealth Tech Digital Transformation Services go far beyond writing code. They focus on improving how your entire business operates. We study client acquisition, onboarding, portfolio management, compliance, reporting, and service delivery. Each stage is reviewed for efficiency and scalability. Our approach blends strategy, experience design, engineering, and system integration. The goal is measurable business outcomes. The result is long-term value, not just technical output.

Wealth Management Software Development specialists understand the financial services ecosystem. They know regulatory demands. They understand data security. They recognize the need for real-time portfolio visibility and precise reporting. This expertise leads to platforms that support advisor workflows. Productivity improves by 40–60%. Operational costs drop by 30–50%. Client experiences improve, which strengthens retention and referrals.

There is no one-size-fits-all answer. Scalability depends on business goals and technical needs. Modern Fintech Platform Development Services often rely on cloud-native architectures. These use microservices that scale independently. We evaluate infrastructure, integrations, security, and growth plans. We then recommend platforms like AWS or Azure. We also assess frameworks such as Node.js or React. The goal is sustainable growth without rework.

Security is embedded into every development phase. It is never treated as an add-on. Secure Financial Data Platform Development includes encryption at rest and in transit. It includes multi-factor authentication and role-based access control. We conduct security reviews throughout the lifecycle. We validate compliance against SEC, FINRA, GDPR, and similar regulations. Every solution undergoes testing before launch. Continuous monitoring follows deployment.

RegTech Compliance Automation Solutions must adapt quickly. We use configurable rule engines instead of hard-coded logic. This allows fast updates when regulations change. Our platforms support automated monitoring and real-time alerts. They maintain complete audit trails. Reporting structures remain flexible. Ongoing updates ensure continuous compliance as regulations evolve.

Returns depend on current systems and implementation scope. Most clients see results within 18 to 24 months. Investment Portfolio Management Software reduces manual work by 30–50%. Advisor capacity increases by 40–60%. Client retention improves by 15–25%. Onboarding becomes 25–45% faster. Infrastructure costs drop by up to 40%. We define success metrics early. Performance is tracked throughout the project.