Table of Contents

- What is Shopify Credit?

- What are the Benefits of Shopify Credit?

- No Interest, No Fees – Period

- No Personal Guarantors or Credit Checks

- Provides You With the Option of Extra Days to Pay

- Receive Cashback Rewards that are Specially Designed for Entrepreneurs

- Let You Enjoy Visa® Perks

- Offers Free Cards for Each of Your Team Members

- How Can You Apply for Shopify Credit?

- How Does Shopify Credit Work?

- Make Payment for All Your Business Expenses With Your Shopify Credit Card

- Make Monthly Payments

- Earn Cashback Rewards

- What are the Key Tips to Make the Most of Your Shopify Credit Card?

- Make Sure That You Pay Your Shopify Bill

- Consider Paying for Marketing Expenses

- Buy New Inventory

- Add Your Virtual Card to Your Mobile Wallet

- Cover Fulfillment and Shipping Costs

Currently, there are about 1.7 million Shopify stores. So, every entrepreneur must maintain a smooth cash flow to thrive in this competitive landscape.

If you are one of them, you may need to look for a credit line to maximize your working capital for every unexpected and expected expense. It is one of the critical things for you to ensure that your business is gaining maturity.

In such a case, you will require an effective solution, i.e., Shopify Credit, primarily built for entrepreneurs. In this definitive blog post, we will let you know about this in detail. So, let’s get started

What is Shopify Credit?

[Image Source: https://bit.ly/45F7m1e]

Shopify Credit is the most recent addition to the suite of financial solutions by Shopify. It is typically a pay-in-full business credit card, which allows you to receive cashback rewards. This product offering is solely meant for entrepreneurs.

If you are an eligible merchant, you can apply for this without causing any impact on your credit score. You can even use your Shopify Credit card to pay wherever Visa® is accepted. It also allows you to receive cashback rewards applied to your account automatically as a statement credit every month. The best part is that you do not have to pay interest or fees.

So, it means that you are assured of receiving all the perks you desire in a business credit card without paying any fees.

If you face difficulties using Shopify Credit, you can hire Shopify developer. They will guide you in the best possible manner.

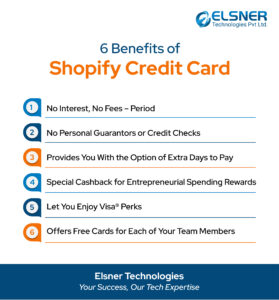

What are the Benefits of Shopify Credit?

Here are a few advantages that you would be able to reap by choosing Shopify Credit:

No Interest, No Fees – Period

One of the significant benefits of Shopify Credit is that it offers you the chance to receive all the perks without incurring any fees. So, you do not have to pay any setup fees, annual fees, late fees, foreign transaction fees, stolen, lost, or card replacement fees.

You are not required to pay any fees for extra cards for your team members. Also, there is no fees-period which is undoubtedly the best part of Shopify Credit.

No Personal Guarantors or Credit Checks

Whenever you apply for a Shopify Credit Card, you only have to wait for a few minutes to get a decision. Note that Shopify Credit does not necessitate guarantors or run credit checks to set you up.

If you are an eligible merchant, you will see your pre-qualified credit limit in your Shopify admin before signing up. The credit limit, in this case, will depend on your business’s performance.

There are two stages of underwriting in Shopify Credit. In the first stage, the underwriting model of Shopify finds out whether your business is eligible to be pre-qualified for Shopify Credit. This model effectively harnesses unconventional and conventional techniques for determining your eligibility in real time.

After applying and undergoing identity verification screening, the Shopify team will closely review your business application. Your eligibility will be confirmed once it is done.

Provides You With the Option of Extra Days to Pay

Running a business comes with uncertainties. You don’t know what is waiting for you the next day. So, one of the most critical advantages of Shopify Credit is that you get extra days to pay. In this case, you will get an additional 25 days after the close of your monthly statement to pay.

Thus, when you use a Shopify Credit card, you get up to 56 days to pay for purchases without incurring interest or late fees.

Receive Cashback Rewards that are Specially Designed for Entrepreneurs

Shopify allows you to get a maximum of 3% cash back on eligible purchases from your top spend category every month and 1% on the other two – fulfillment, marketing and wholesale. In this case, rewards will be automatically displayed as a statement credit on every monthly statement.

Let You Enjoy Visa® Perks

By covering your business expenses with Shopify Credit, you could leverage the advantage of all the Visa® perks. It includes travel and emergency assistance, extended purchase protection, auto collision and damage waiver, and more.

At the time of launch, every merchant using Shopify Credit can also get access to Shop Cash offers. It is regarded as a channel restricted to merchants on Shopify Plus.

Offers Free Cards for Each of Your Team Members

Whenever you sign up for Shopify Credit, you can offer staff their own cards for free. Also, you will get the option to set spending limits to manage your business spending effectively. Additionally, on every eligible purchase, your staff can earn cashback rewards. As a result, every penny your entire team spends on your business is put to work.

Shopify Credit also comes with Visa® Zero Liability, which offers complete protection if your card is fraudulently used, stolen or lost.

How Can You Apply for Shopify Credit?

One of the exciting things to note about Shopify Credit is that it is only available to a limited number of pre-qualified Shopify merchants in the United States. In this case, most pre-approved merchants can expect to receive a decision within minutes.

If approved, you will get immediate access to your credit line. Also, you can use the virtual card issued to you instantly. In case you want, you can even request a physical card, especially for in-person business purchases. You will get your card through the mail. It is expected to reach you within 5 to 7 business days.

To know whether you are eligible to apply for Shopify Credit, you need to log in to your Shopify admin. You can even visit Shopify’s Help Center for more information about eligibility requirements.

How Does Shopify Credit Work?

Using Shopify Credit is simple, allowing you to make the most out of your money. It also helps you to run your business with confidence.

Make Payment for All Your Business Expenses With Your Shopify Credit Card

As a Shopify entrepreneur, you are expected to spend a lot of money on shipping and fulfillment, advertisement and marketing, and wholesale and inventory. It would help if you attempted to pay for all these expenses with your Shopify Credit. By doing so, you can offer considerable time to pay for all those expenses, which liberates cash flow for other things.

Pro Tip: Consider setting Shopify Credit as your default payment method on Shopify and anywhere else you spend on your business where there is acceptance of Visa®. It will allow you to get rewards even quicker.

Make Monthly Payments

It is easy to stay on top of payments with Shopify Credit. In this case, your statement balance is automatically paid in full from your Shopify Balance account or designated bank. It occurs on the 25th day of every month after the close of your monthly statement.

With the automatic payments feature of Shopify Credit, you will get a maximum of 56 days to make payments for any business purchases. The best part is that it has no revolving balance, fees, or interest.

Pro Tip: If you pay a part of your Shopify Credit card balance before your statement is due, you can withdraw the remaining balance on the 25th. However, there will not be any automatic withdrawals from your specified bank account mainly on the due date in case you decide to pay the entire balance before the due date.

Earn Cashback Rewards

Shopify Credit helps you receive a maximum of 3% cash back on every eligible purchase, particularly in your highest spending category, between shipping and fulfilment, advertising and marketing, and wholesale and inventory. It also lets you earn 1% cashback for eligible purchases in the other two categories.

Your rewards will be automatically applied to your account as a statement credit every month. Shopify will solely handle all sorts of calculations, so you do not have to be concerned about anything. But, if you want to view a comprehensive breakdown of your accumulated cashback for the month, you can do it once every statement period closes in your Shopify admin.

What are the Key Tips to Make the Most of Your Shopify Credit Card?

Here are a few fantastic tips that you need to follow to make the most out of your Shopify Credit card:

Make Sure That You Pay Your Shopify Bill

As your business is already on Shopify, now is the perfect opportunity for you to earn rewards. To do so, you must set your Shopify Credit card as your default payment method on Shopify. It will allow you to get rewards automatically on every eligible purchase.

Consider Paying for Marketing Expenses

You can choose to pay for marketing expenses, and in turn, you can get rewards. For example, advertising on Meta, Google, Pinterest, TikTok, etc., will allow you to gain rewards.

Buy New Inventory

You should use a Shopify Credit card whenever you spend on refreshing and restocking your inventory. It will let you earn cash back on every purchase from suppliers and vendors through marketplaces such as Faire.

Add Your Virtual Card to Your Mobile Wallet

You can consider adding Shopify Credit to your mobile wallet. It will allow you to make easy and contactless payments on the go.

Cover Fulfillment and Shipping Costs

Whenever you use your Shopify Credit card, you can save a lot on Shopify Shipping, UPS, USPS, Flexport, Shopify Fulfillment Network, and more.

Final Thoughts

So, Shopify Credit is more than just a credit card. It has presently turned out to be a strategic partner in your entrepreneurial journey. This solution is designed to simplify your financial management and fuel your business ambitions.

With unmatched flexibility, exceptional rewards and no fees, it is the perfect time to explore the possibilities that Shopify Credit can unlock for your business.

To reap maximum advantages out of this, you can choose to opt for best-in-class Shopify development services.

Digital Transformation begins here!

Let us write your business’s growth story by offering innovative, scalable and result-driven IT solutions. Do you have an idea that has the potential to bring a change in the world? Don’t hesitate. Share with our experts and we will help you to achieve it.